by Brian Eckhouse and Joe Deaux, Bloomberg

The Trump administration imposed a tariff on steel imports last year to get companies to buy more American metal. In some ways, the duty has the U.S. solar business doing the exact opposite.

Consider the case of PanelClaw Inc., a supplier of steel racks that hold solar panels in place. Since President Donald Trump slapped tariffs on steel and aluminum last year, the Massachusetts-based company has boosted its sourcing of completed racks from India, allowing it to skirt some of the duties that apply to raw metals only.

While PanelClaw still acquires racks made domestically with American steel, the company can partly “avoid the tariff” by importing the rest, Chief Executive Officer Constantino Nicolaou said in a telephone interview.

PanelClaw isn’t alone. California-based Nuance Energy, another solar-racking company, has also boosted overseas sourcing, including from China, Malaysia and Mexico, since the steel tariffs were imposed. Increasing overseas sourcing further is “on the table” if tariffs rise, Chief Executive Officer Brian Boguess said by phone.

Difficult Luxury

Here’s the downside: looking overseas won’t boost U.S. jobs. “We like creating jobs locally,” Nicolau said. But “the luxury became much more difficult with the steel tariff.”

Steel prices for U.S. buyers rose about 14 percent last year after Trump, contending that foreign metal threatened U.S. national security, slapped tariffs on all steel imports under Section 232 of the Trade Expansion Act of 1962. Tariffs raise the price of imports to make them on par with domestic goods.

Unlike other commodities, steel is priced regionally. So American steel costs about 44 percent more than Chinese steel and about 31 percent more than European steel, meaning U.S. metal is the most expensive in the world right now for consumers. A key reason: the tariffs.

But the obscure trade law applied only to raw steel, leaving value-added products of the metal, such as car parts, airplane parts and, yes, solar parts, shielded from the tax.

Company Warnings

In the months before and after the imposition of steel and aluminum tariffs, U.S. companies that use metals warned that the duties would raise raw-material costs, cutting into their margins. At the time, demand continued rising, and customers continued to pay higher prices set by steelmakers including Nucor Corp. and steel consumers such as Caterpillar Inc.

But uncertainty during the final quarter of last year smothered the boom narrative. Companies didn’t exactly predict contraction, but they started sending signals that the tariffs were eroding the strong demand that they had seen in the earlier part of the year. Now they suggested that the second half of 2019 was difficult to predict.

American steelmakers’ shares have fallen in the 11 months since Trump imposed the tariffs, suggesting that investors aren’t convinced that the trade policy is having its intended impact. The S&P Supercomposite Steel index has fallen 4 percent.

“Even with the price of U.S. steel coming down, it’s still advantageous to buy imported steel,” said Gordon Johnson, a New York-based analyst at Vertical Group who focuses on solar and metals.

Analysts speculated that one of the unintended consequences of the metal tariffs would compel domestic producers of finished steel products to move plants outside the U.S. This would allow the companies to source the cheapest metal they could find anywhere in the world, then produce parts that could be sold tariff-free back into the U.S.

There’s also the matter of financing. Boguess said his company has been absorbing the tariff for imported material, meaning it pays more for foreign metal than domestic metal. But foreign sellers are providing favorable terms, which dissuades the use of domestic metal.

The tariffs may already be having a perverse impact on exports from the U.S. They prompted California-based NEXTracker Inc., for example, to reduce exports, said Chief Executive Officer Dan Shugar. The company, which helps solar farms track the sun, could do so because it already sources and supplies systems on several continents.

Like NEXTracker, PanelClaw already had access to an overseas supply chain. Back in 2009, amid growth, it conducted a global manufacturing search and identified options in China and India. “We thought there’d be an administration at some point that would go after China over trade imbalance,” Nicolaou said. So PanelClaw settled on India.

Racking Pain

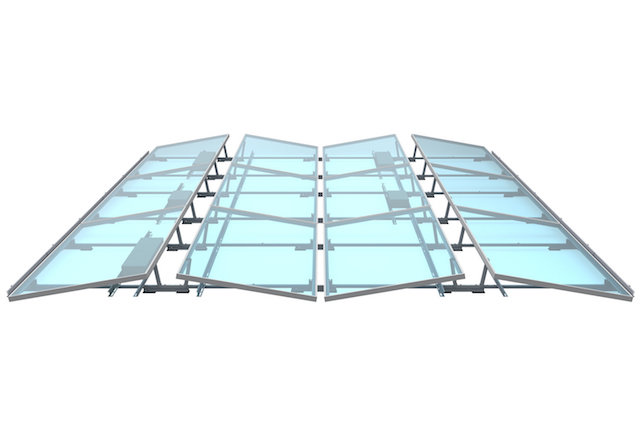

Among solar companies, the pain of the tariffs has been especially acute for racking companies that source the equipment needed to affix solar panels to the ground or atop roofs.

Steel is prominent in racking, so companies that can build such systems with less of it could be favored if the tariff endures. Steel also makes up about a quarter of the cost to install solar-car ports, said Tom Werner, chief executive officer of SunPower Corp., one of the biggest U.S. solar-panel manufacturers.

Developers of U.S. solar farms are also feeling the pinch. The tariffs can add one or two cents per watt to project costs, which could mean up to $1.5 million more to develop a 75-megawatt project, according to developer Cypress Creek Renewables LLC.

“That means we have less money to invest in our future pipeline of projects,” said Mike Belikoff, an executive vice president at Cypress Creek.

Renewable energy project development is a big part of the education at POWERGEN International. Learn about the event here.