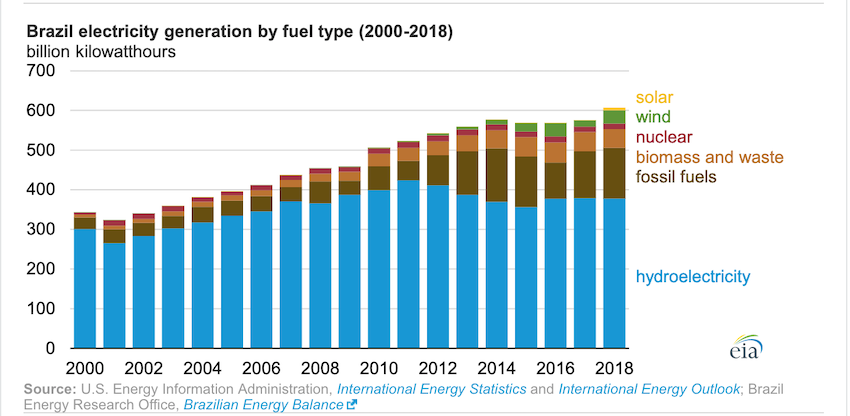

Brazil is the second-largest producer of hydroelectric power in the world, after only China, and hydropower accounted for more than 70% of the country’s electricity generation in 2018. Brazil’s latest 10-year energy plan seeks to maintain this level of hydro generation while increasing the share of nonhydro renewables, particularly solar.

Most of Brazil’s hydroelectric plants are located in the country’s Amazon River basin in the north, but Brazil’s demand for electricity is mainly along the eastern coast, particularly in the southern portion. Reliance on hydropower for most of the country’s electricity generation, combined with the distant and disparate locations of its demand centers, has presented electricity reliability challenges.

After a three-year drought in Brazil from 2012 to 2015, uncertainty about water supply led to increased diversification in more nonhydroelectric generation technologies. Natural gas consumption increased, but concerns about the availability of natural gas (Brazil currently consumes more natural gas than it produces) and increased CO2 emissions from fossil fuels in general have led energy policymakers to set higher targets for the development of nonhydro renewables.

As part of its 10-year energy expansion plan, Brazil expects nonhydro renewables to grow by about 3% per year and reach up to 28% of the domestic energy mix by 2027. The latest plan—Plano Decenal de Expansão de Energia (PDEE) 2027—focuses on a significantly increased expansion of solar photovoltaic (PV) capacity, while hydroelectricity capacity remains above 50%. The PDEE 2027 expects installed solar PV capacity to increase to 8.6 gigawatts (GW) by 2027, up from 2.5 GW in February 2019.

Brazil currently supports utility-scale PV development through energy auctions conducted by the National Electric Energy Agency with auctions of new and existing projects. The upcoming 2019 A-4 auction—for projects that will be commissioned within the next four years—will admit only renewable generation technologies, including solar PV, wind, biomass, and hydropower. Solar PV accounted for the largest share in the 2018 A-4 auction, with about 800 megawatts (MW) of contracted capacity.

Brazil’s plans to increase its share of nonhydro renewables also include distributed solar generation, which includes off-grid arrays up to 5 MW. Brazil currently has more than 500 MW of installed distributed-generation solar capacity. More than 49,000 solar PV systems were operational under net metering in Brazil at the end of last year, about 75% of which were residential installations. The government projects that 2.7 million consumer units could provide 23.5 GW of electric generation capacity by 2030.