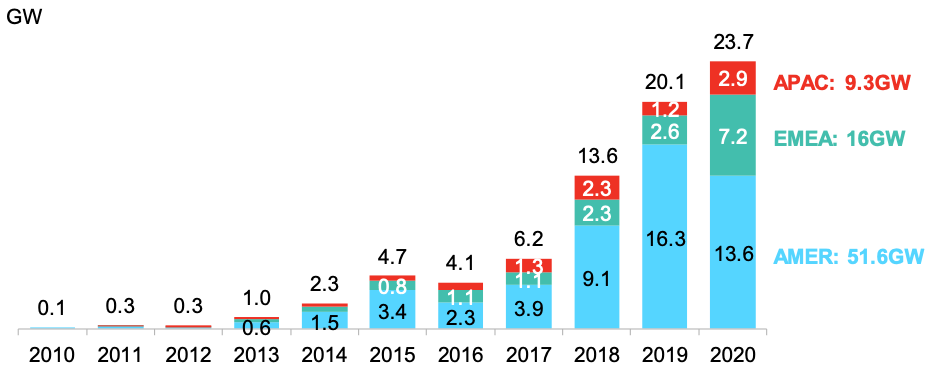

Corporations purchased a record of 23.7 GW of clean energy in 2020, up from 20.1GW in 2019 and 13.6GW in 2018, according to new research published by BloombergNEF (BNEF). The increase came despite a year devastated by the Covid-19 pandemic, a global recession and uncertainty about U.S. energy policy ahead of the presidential election.

The analysis is presented in BNEF’s latest report, 1H 2021 Corporate Energy Market Outlook. It shows that clean energy contracts were signed by more than 130 companies in sectors ranging from oil & gas to big tech. Underpinning the market is surging stakeholder interest in corporate sustainability and expanding access to clean energy globally.

The U.S. was once again the largest market, but was less dominant than in previous years. Companies announced 11.9 GW of corporate PPAs in the U.S. in 2020, down from 14.1 GW in 2019 – the first year-on-year drop since 2016. The first half, coinciding with the start of the pandemic, was particularly subdued, with companies announcing just 4.3 GW of corporate PPAs in the U.S. in that period.

Kyle Harrison, BNEF senior associate and the lead author of the report, commented: “Corporations faced a wave of adversity in 2020 – internal corporate functions were disrupted on the outset of the pandemic, and many companies saw revenues plummet as global economies buckled. Question marks before – and after – the U.S. election further complicated long-term decision-making for companies. To not only maintain, but grow, the clean energy procurement market under these conditions is a testament to how high sustainability is on many corporations’ agendas.”

Region by Region

In Latin America PPA volumes dropped from 2G W in 2019 to 1.5G W in 2020. The region was hit hard by the Covid-19 pandemic and the economic downturn. Yet companies in Brazil signed a record 1,047 MW of corporate PPAs in 2020, as many continued to migrate to the country’s free market, where they can sign bilateral clean energy contracts directly with developers.

Once the main draw for corporate procurement in the region, Mexico saw deal volumes all but dissipate, as the current administration continues to undermine the country’s clean energy sector.

While the U.S. and Latin America slipped back, other corporate procurement markets stepped up, said BNEF. Corporate PPA volumes in the Europe, Middle East and Africa (EMEA) region rose from 2.6 GW in 2019 to a record 7.2 GW in 2020. In Spain, companies announced contracts to purchase 4.2 GW of clean energy, up from 300 MW the previous year. Solar and wind projects in Spain yield some of the cheapest and most competitive prices in Europe, thanks to strong natural resources and a large pool of experienced developers, according to BNEF. Further, companies like Total and Anheuser Busch are orchestrating ‘cross-border virtual PPAs’ in Spain, buying clean energy in the country to offset their load elsewhere in Europe.

Corporations also purchased record clean energy volumes in the Asia Pacific (APAC) region, announcing contracts for 2.9 GW of solar and wind. In a first, Taiwan corporations signed PPAs totalling 1.25 GW. Taiwan’s market should be supported by a new policy that requires companies with an annual load above 5 MW to buy clean power. Also, the island has a high concentration of large manufacturers, many of which are feeling pressure from their customers to decarbonize.

South Korea is expected to be the next major corporate procurement market in Asia. Policymakers revised the country’s Electric Utility Act in the beginning of 2021, creating a PPA mechanism and a green tariff program with Korea Electric Power Corporation. The revision will also allow companies to purchase unbundled certificates and retire them against sustainability commitments. South Korean companies face similar supply chain pressures to those in Taiwan.

Jonas Rooze, lead sustainability analyst at BNEF, said: “More than ever before, corporations have access to affordable clean energy at a global scale. Companies no longer have an excuse for falling behind on setting and working towards a clean energy target.”

Who is Leading the Pack?

Amazon was the leading buyer of clean energy in 2020, announcing 35 separate clean energy PPAs in 2020, totalling 5.1 GW. The company has now purchased over 7.5 GW of clean energy to date, vaulting it ahead of Google (6.6 GW) and Facebook (5.9 GW) as the world’s largest clean energy buyer. French oil major Total (3 GW), TSMC (1.2 GW) and U.S. telecom Verizon (1 GW) were the next largest corporate buyers of clean energy in 2020 (see Figure 2).

The flow of new companies making clean energy commitments is another indicator of how much more the market can grow. Some 65 new companies joined the RE100 in 2020, pledging to offset 100% of their electricity consumption with clean energy. BNEF forecasts that the 285 RE100 members will collectively need to purchase an additional 269TWh of clean electricity in 2030 to meet their RE100 goals. Should this shortfall be met exclusively with offsite PPAs, it would catalyze an estimated 93GW of new, incremental solar and wind build.

Harrison commented: “Investor interest in sustainability is sky high, with inflows to sustainability-focused funds growing 300% between 2019 and 2020. Companies in all sectors, including hard-to-abate ones like oil & gas and mining, are feeling the pressure to purchase clean energy and decarbonize. This group is only just scratching the surface on the amount of clean energy build it can catalyze.”

Figure 2: Top corporate clean energy buyers, 2020

Source: BloombergNEF. Note: Chart is in MW DC and includes offsite PPAs only. Data is based on public announcements.