Wind and other renewables are driving America’s all-of-the-above energy mix because they are increasingly the lowest-cost electricity source. But their rapid growth rates are bringing change not only to the energy industry as a whole, but also within each renewable sector. It is a maturation process that is accelerating growth opportunities – for wind industry companies with the ability to seize them.

One of the key trends in the wind industry’s maturation is repowering established wind farms with new, more powerful turbines. The latest example is our newest repower deal with PacifiCorp

for the Goodnoe Hills wind farm in Washington. This deal replaces the ten-year old Senvion turbines on this wind farm with powerful V110-2.2 MW Vestas turbines, bringing the project’s nameplate capacity from 94 MW up to 103 MW. This is the second repower deal Vestas has signed with PacifiCorp this year, following the 234 MW order to repower Marengo I and II, which are also in Washington.

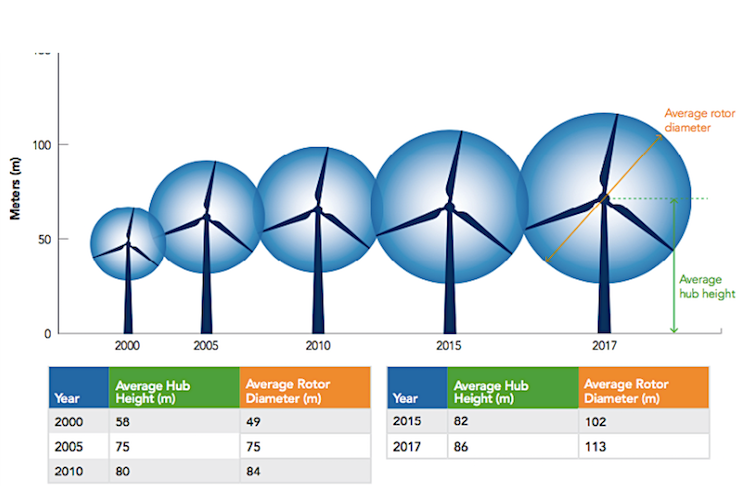

At the heart of these changes is bigger equipment that can produce more power with the same land footprint. Since 2008, bigger rotors and better turbines have cut wind-energy costs nearly 70 percent while U.S. wholesale power prices fell 60 percent. Today, there are over 54,000 wind turbines spinning in 41 states. Together, they produce over 90 GW of electricity – enough to power 24 million typical American homes. This is a trend that’s likely to continue. Last year, the National Renewable Energy Laboratory reported that new technology can lower wind costs another 50 percent and “drop the unsubsidized cost of wind energy below the projected cost of fuel for existing natural gas plants by 2030.”

Modernize Old Wind Farms by Repowering

The rapid spread of wind turbines and the significant growth in their ability to produce power has produced a fleet for which maintaining and upgrading existing wind projects is now almost an industry itself, creating an opportunity to save customers additional money. Of the wind turbines operating today, nearly 45 percent (about 40 GW) were installed between 2005 and 2011. Exponential technological innovation means the turbines of 5-10 years ago barely resemble the highly efficient and powerful turbines of today.

The rapid spread of wind turbines and the significant growth in their ability to produce power has produced a fleet for which maintaining and upgrading existing wind projects is now almost an industry itself, creating an opportunity to save customers additional money. Of the wind turbines operating today, nearly 45 percent (about 40 GW) were installed between 2005 and 2011. Exponential technological innovation means the turbines of 5-10 years ago barely resemble the highly efficient and powerful turbines of today.

These are the turbines that are ripe for “repowering” to upgrade their performance, lower their long-term maintenance costs and improve their profitability. Partial repowering is the partial replacement of the wind farm equipment. In short, it’s putting better equipment –– on top of existing towers. That allows more powerful, more profitable and easier-to-maintain equipment to be installed without having to grade more land and pour additional concrete for new towers.

Why Wind Repowering Makes Business Sense

Repowering is attracting the attention from a wide variety of wind farm owners because it drives profits and savings in a number of ways:

- Repowering with new wind turbines can let owners improve AEP (annual energy production) by 20-25 percent. This is because capacity factors of new wind turbines (2-5 years old) are typically 10-15% higher than the capacity factor of turbine technology from 2005-2010.

- Today’s turbines are considerably larger and more powerful than those built 10-20 years ago. It’s now common in 2018 to install turbines of 2, 3, and 4MW nameplate capacity, compared to the 660KW average capacity of turbines installed in 2000.

- Repowered wind farms can re-qualify for a 10-year extension of the federal production tax credit status if 80 percent of current turbine value is invested in repowering.

- Repowering can also make life simpler for wind-energy customers because the new technology includes service and operating savings. The new equipment is more reliable and less costly to service, and servicing a uniformly repowered fleet opens economies of scale that significantly drive down operating costs.

Opportunities for Those Able to Seize Them

The U.S. wind turbine fleet is big enough to create a new line of business for wind industry players in repowering. But the repowering can’t be done by just anyone. Many wind farm owners have equipment from several different manufacturers – what’s called a “multi-brand fleet.” Some of those original equipment manufacturers (OEMs) that installed the older equipment are no longer active, making upgrades, and availability of components and repair more complicated. The multi-brand repowering provider has to have the depth of knowledge and experience to put new equipment on a variety of existing towers, and the ability to manage the technology complexity and risk associated.

Bigger opportunities will require bigger providers to meet the demand from a rapidly expanding repowering market. Last year, 2 GW of partial repowering projects were completed in the U.S., compared to 7 GW in total wind capacity installed in 2017. Analysts expect repowering to reach as many as 30 percent of U.S. wind farms by 2021, according to Bloomberg New Energy Finance, and spur a $25 billion annual U.S. investment by 2030, according to NREL.

For repowering wind farms, everything old can indeed be new again. U.S. energy owners, customers and consumers get the benefit – the latest in low-cost, reliable and renewable power on our grid, and gigawatts closer to the promise of America’s clean-energy future.